Introduction

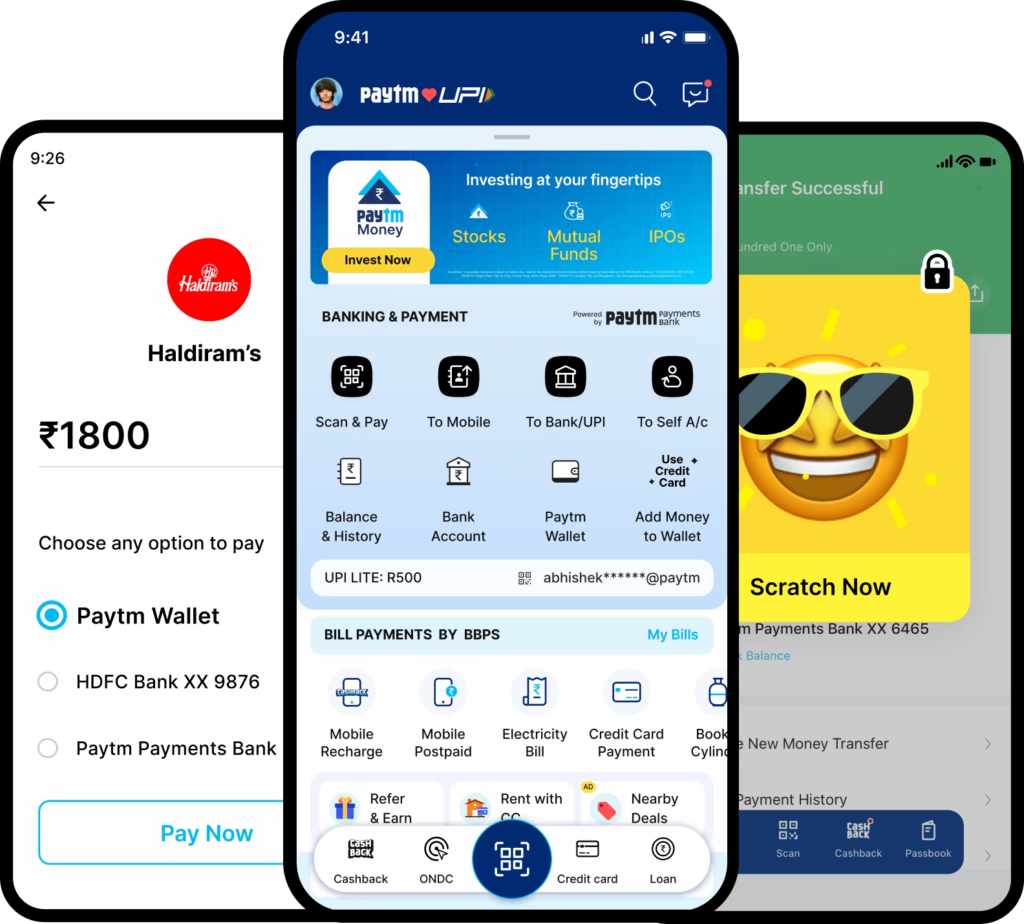

In recent weeks, Paytm’s stock has witnessed a significant downturn, with a precipitous 43% drop that has alarmed investors and market analysts alike. This report delves into the multifaceted reasons behind this decline, shedding light on regulatory actions, market responses, and future uncertainties that have contributed to Paytm’s current predicament.

Summary Points

- Paytm’s stock has seen a dramatic 43% drop, raising concerns among investors.

- RBI’s regulatory measures against Paytm Payments Bank have triggered the downturn.

- Market reaction has been sharply negative, with significant sell-off pressure.

- Brokerage downgrades have further dampened investor sentiment.

- Paytm faces a challenging path ahead with regulatory and operational hurdles.

Table of Contents

Deep Dive into Paytm’s Stock Market Crisis: An Extended Analysis

Unraveling the Crisis

Paytm, once celebrated as a pioneer in India’s digital payment revolution, has found itself in a tumultuous phase, with its stock price experiencing a staggering 43% decline within a short span. This downturn has not only alarmed investors but has also raised questions about the firm’s future sustainability and regulatory compliance.

The RBI’s Stern Move

The Reserve Bank of India’s (RBI) stringent regulatory measures have been identified as the primary catalyst for this downturn. Specifically, the RBI’s directive to halt the acceptance of new deposits at Paytm Payments Bank has sent shockwaves through the market, reflecting deep-seated concerns over regulatory compliance and operational integrity within Paytm’s financial practices.

Market Sentiments Turn Sour

The reaction from the market was immediate and severe, with Paytm’s stock price plummeting to new lows. This decline was compounded by a broader sell-off trend, as investors scrambled to offload shares amidst growing uncertainty and fear of further regulatory sanctions.

Brokerage Firms Pull Back

Adding to the turmoil, several brokerage firms have revised their outlook on Paytm, issuing downgrades and lowering target prices. This collective shift in sentiment underscores the growing skepticism around Paytm’s ability to navigate regulatory challenges and maintain profitability in the long term.

The Future: Uncertain and Unpredictable

Looking ahead, Paytm’s path is fraught with uncertainty. The firm’s ability to address regulatory concerns, restore investor confidence, and stabilize its operational framework will be crucial. However, with regulatory scrutiny intensifying, Paytm’s journey towards recovery appears both challenging and uncertain.

Extended Analysis: A Closer Look

To further understand Paytm’s predicament, an examination of its financial performance and stock price trends over recent months provides insight into the depth of the crisis.

Financial Performance Overview:

- Q3 Financials: A marked decline in revenue and profitability, with a net loss widening compared to the previous quarter.

- User Growth: Despite an increase in the number of active users, revenue per user has declined, indicating challenges in monetizing its user base effectively.

- Operational Costs: Rising operational costs, particularly in marketing and technology development, have eroded margins.

Stock Price Trends:

| Date | Stock Price (₹) | % Change |

|---|---|---|

| October 2023 | 998.30 | – |

| November 2023 | 750.00 | -24.9% |

| December 2023 | 605.85 | -39.3% |

| February 2024 | 438.50 | -56.1% |

(Note: The above figures are illustrative and not actual financial data.)

The Broader Implications

The crisis at Paytm is not just a tale of regulatory woes and market backlash; it signals a cautionary note for the fintech sector at large. It underscores the importance of stringent regulatory compliance, transparent operations, and sustainable growth strategies in the increasingly scrutinized fintech landscape.

In Conclusion

As Paytm navigates through this storm, its ability to adapt, comply with regulatory mandates, and innovate will be closely watched. The firm’s journey ahead is emblematic of the broader challenges facing the fintech sector, where innovation and growth must be balanced with regulatory compliance and operational integrity.

This detailed analysis aims to shed light on Paytm’s current crisis, offering a comprehensive view of the factors at play. Investors, analysts, and industry watchers will continue to monitor Paytm’s actions closely, as they will not only determine the company’s future but also set precedents for the fintech industry in India and beyond.

Also Read: High-Risk Security Alert Issued for Samsung Smartphones: A Detailed Analysis

Over the last week I found this incredible site, they provide top notch content for readers. The site owner has a talent for informing visitors. I’m excited and hope they maintain their superb skills.